Best Miles and Points Credit Cards for Beginners

The vast majority of our travel is subsidized by miles and points. They save us thousands of dollars every year. Miles and points have funded more toddler temper tantrums in other states than I can count. Precious memories, obviously.

I only started collecting miles and points in the last couple of years. Before that time, I assumed multiple credit cards would ruin my credit. I had one credit card I used for everything that provided modest benefits at best. It kills me to think how much I used to pay out of pocket for travel unnecessarily.

I know entering the miles and points world is overwhelming. There is a steep learning curve and a lot of which you need to keep track. Each credit card company has its own standards for applications, and each reward program has its own rules. It is a lot to process. Don’t let that freak you out. The hassle is definitely worth it. Outlined below are some of the best miles and points credit cards for beginners.

As an Amazon Associate, I earn from qualifying purchases.

DISCLOSURE: This post may contain affiliate links, meaning when you click the links and make a purchase, we receive a commission.

Credit Cards Best Practices

Annual Fees and Retention Offers

Credit cards come with annual fees. There is no question it is worthwhile to pay the annual fee the first year in exchange for an introductory bonus, but it may not be going forward if you decide the card is not for you long term. When If you find yourself in this situation, contact the company and ask for a retention offer. Credit card companies will often offer something to stay, like a statement credit or opportunity to earn extra miles. At a minimum, most will let you do a product change to a no annual fee card. This keeps the card open on your credit report so you won’t look like an obvious churner, even if you don’t use the card.

Wait until the annual fee posts to ask for a retention offer. If you don’t hold the card for a full year, some companies, like American Express, may take the introductory bonus back. Most companies will refund the annual fee if you contact them within 30 days after it posts. If you downgrade to a no annual fee card, they will usually pro rate the annual fee.

Pay Your Bills in Full

Just because you have more credit cards does not mean you need to spend more than you normally would. Make sure you can pay the bills in full each month. If you have to pay monthly fees and interest, the miles and points are not worth it. Miles and points are supposed to save you money, not the other way around.

Credit Card Applications

It is important to space out your applications and apply in a strategic order. If you take out too many too fast, you will inevitably start getting denied. A quick google search can give you the most up to date information about your odds of getting approved for a particular card. Make sure your credit falls within the required range and that you haven’t exceeded the number of recent credit cards that company will tolerate. Try to avoid wasted hard pulls on your credit report.

Miles and Points Credit Cards for Beginners by Company

There are several companies that offer great miles and points credit cards for beginners. Why do you want so many credit cards? Because with new credit cards comes great introductory bonuses and benefits. It is very unlikely you can get everything you want and need with one card. All the information provided is up to date as of the time of this writing, but offers change constantly, so check the terms before you submit an application. The values of the introductory bonuses are approximates. They vary based upon the value of the travel on which you choose to redeem them.

Chase Miles and Points Credit Cards for Beginners

Chase is great for beginners. In fact, Chase prefers them. If you have taken out or been listed as an authorized user on someone else’s card 5 times in the last 24 months, you will be denied. This is 5 cards from any company, not just Chase cards. This lovely policy is known as 5/24. Let’s just say I will not be approved for a Chase card anytime soon, if ever again. Hey, Chase, get over yourself.

Putting aside my disdain for 5/24, Chase has some excellent products to consider. Apply for these first, and don’t list your partner as an authorized user if it can be avoided. You don’t want to increase his or her 5/24 count, because let’s be honest, you’ll be in two player mode before you know it. You can refer your partner if they take out the same card to get extra miles and points, even if he or she is an authorized user on your card. By doing so, your family can get each introductory bonus twice, plus a referral bonus for one of you. You can also earn an introductory bonus on the same card more than once if you wait the specified amount of time before reapplying (check the individual applications).

Chase Sapphire Preferred

Chase Sapphire Preferred is a flexible travel card. You earn Chase Ultimate Rewards points. These points are redeemed within Chase’s portal on most travel, including flights, hotels (but not Disney), and rental cars. You can also transfer Ultimate Rewards points to its partners, including Hyatt and Southwest. You earn two points per dollar on travel and dining and one point per dollar on everything else. I have used Ultimate Rewards points to book rental cars through Chase’s portal for a 25% bonus, and transferred points to both Hyatt and Southwest.

Introductory Bonus: 60,000 Ultimate Rewards points after spending $4,000 in the first three months

Value of Introductory Bonus: Between $600 to $900, depending upon your choice of redemption

Annual Fee: $95

Chase Freedom

Remember the retention offer thing? This is why I currently hold this card. I did a product change from Chase Sapphire Preferred to this no annual fee card. However, unlike most of the cards I hold only to keep the accounts open, I actually use this one. Chase Freedom offers 5% back on rotating categories throughout the year. You can get cash back on this card or use the earnings as Ultimate Rewards points. If you apply for Chase Freedom as a new card, you get an introductory bonus, but you will not qualify for one if you do a product change from another card.

Introductory Bonus: $200 after spending $500 in the first three months

Value of Introductory Bonus: $200

Annual Fee: None

Southwest Rapid Rewards Plus Card

Southwest Rapid Reward Plus earns two Rapid Rewards points per dollar on Southwest purchases, and one point per dollar on everything else. You also get 3,000 Rapid Rewards points on each anniversary of your card. I have seen better introductory offers than the one offered today on this card in the past, so you may want to check back periodically before applying. We used the Rapid Rewards points earned on these cards to go to both California and Orlando.

Introductory Bonus: 65,000 Rapid Rewards points after spending $2,000 in the first three months

Value of Introductory Bonus: Approximately $975

Annual Fee: $69

Disney Premier Visa Chase

Disney Premier Visa Chase is the card I used exclusively for a long time. That was a big mistake. This card pays two percent on gas, groceries, restaurants, and Disney purchases. You redeem the earnings for Disney purchases only. We love us some Disney, so this card seemed to make sense, but there are better ways to save money on Disney trips. With that said, there is a no annual fee version available to which you could do a product change. The card has a few small perks, like character meet and greets at the parks, so you may want to consider it if you are traveling to Disney.

Introductory Bonus: $200 after spending $500 in the first three months

Value of Introductory Bonus: $200

Annual Fee: $49

United Explorer Card

United Explorer Card earns two United miles per dollar on restaurants, hotels, and United Airlines purchases, and one mile per dollar on everything else. The card also comes with a free checked bag for you and a companion.

Introductory Bonus: 40,000 United miles after spending $2,000 in the first three months

Value of Introductory Bonus: Approximately $520

Annual Fee: $95, waived the first year

World of Hyatt Credit Card

World of Hyatt Credit Card earns four Bonus Points per dollar on Hyatt purchases, two points per dollar on restaurants, airfare, transit, and gym memberships, and one point per dollar on everything else. You earn one free night on each card anniversary, and an additional free night if you spend $15,000 in a year.

Introductory Bonus: 25,000 Bonus Points after spending 3,000 in the first three months, plus an additional 25,000 Bonus Points after spending $6,000 within the first six months

Value of Introductory Bonus: Approximately $850

Annual Fee: $95

Barclays Miles and Points Credit Cards for Beginners

Barclays is pretty impressed with itself. It has a reputation for declining people who have taken out a few cards recently. Barclays is also quite stingy with its retention offers. It does, however, have some pretty great miles and points credit cards for beginners. Apply for Barclays cards on the early side. You can earn the introductory bonuses on cards more than once if you wait long enough to reapply.

AAdvantage Aviator Red World Elite Mastercard

AAdvantage Aviator Red World Elite Mastercard earns two AAdvantage (American Airlines) miles per dollar on American Airlines purchases and one mile per dollar on everything else. The card provides a free checked bag for yourself and four companions. You can also earn a companion certificate for one guest to travel domestically for $99 if you spend $20,000 in a year.

Introductory Bonus: 60,000 AAdvantage miles after making any purchase and paying the annual fee

Value of Introductory Bonus: Approximately $840

Annual Fee: $99

JetBlue Plus Card

JetBlue Plus Card pays six TrueBlue points per dollar on JetBlue purchases, two points per dollar on restaurants and groceries, and one point per dollar on everything else. It includes a free checked bag for you and three companions.

Introductory Bonus: 40,000 TrueBlue points after spending $1,000 in the first 90 days

Value of Introductory Bonus: Approximately $520

Annual Fee: $99

Capital One

Venture Rewards from Capital One

Venture Rewards from Capital One is the only real travel card from Capital One as of the time of this writing. Capital One tends to decline people with a lot of recent cards. You can earn the introductory bonus more than once if you wait the required amount of time, and you can refer your partner to get his or her own card.

The Venture Rewards card is a flexible card that allows you to erase any travel expense from your statement. The card pays two percent on everything. You can do better with other cards in some categories of spending, but this is a great card to use for basic household bills. I have seen better introductory bonuses than the one currently offered, so you may want to watch it for awhile before applying. We used this card to erase a large portion of our trip to LEGOLAND California.

Introductory Bonus: 50,000 Bonus Miles after spending $3,000 in the first three months

Value of Introductory Bonus: $500

Annual Fee: $95

Citibank Miles and Points Credit Cards for Beginners

Citibank is great because it plays fast and loose with its approvals. I have seen comments online suggesting inanimate objects have been approved. Citibank does not seem to care at all how many cards you have taken out recently. I have found it to be a very easy approval. You can probably safely save these until after the companies listed above. You can earn introductory bonuses on the same product more than once.

Citi Premier Card

Citi Premier is a flexible travel card that earns ThankYou Points. You use the ThankYou Points you earn to book travel through its travel portal. It earns three ThankYou Points per dollar on gas, two points per dollar on restaurants and entertainment, and one point per dollar on everything else. We used ThankYou Points to book rental cars and Loews Portofino Bay at Universal Studios Florida.

Introductory Bonus: 60,000 ThankYou Points after spending $4,000 in the first three months

Value of Introductory Bonus: Approximately $1,020 depending upon your choice of redemption

Annual Fee: $95

Citi AAdvantage Platinum Select World Elite Mastercard

Citi AAdvantage Platinum Select World Elite Mastercard earns two AAdvantage miles per dollar spent on miles, gas, and American Airlines purchases, and one mile per dollar on everything else. You can earn an additional $125 American Airlines flight credit after spending $20,000 in a year. You receive a free checked bag for yourself and four companions.

Introductory Bonus: 50,000 AAdvantage miles after spending $2,500 in the first three months

Value of Introductory Bonus: Approximately $700

Annual Fee: $99, waived the first year

American Express Miles and Points Credit Cards for Beginners

American Express cards are also pretty easy to come by. I have a bunch, and I got most of them after I took out several recent cards from other companies. You can refer your partner, even if he or she is an authorized user on your card. I tend to use American Express cards more than those of any other company long term. The cards have good earnings and offer extras.

American Express does get a big thumbs down because you can only earn the introductory bonus once per lifetime on each product. You can, however, earn introductory bonuses on multiple cards within each family. For example, you can take out multiple Delta cards as long as they are not the same version.

Delta SkyMiles Gold American Express Card

Delta SkyMiles Gold earns two Delta SkyMiles per dollar on restaurants, groceries, and Delta purchases, and one mile per dollar on everything else. You can also earn a $100 Delta flight credit after spending $10,000. It includes a free checked bag for everyone in your party. I have definitely seen better introductory bonuses in the past, so you may want to watch this one as well.

Introductory Bonus: 35,000 SkyMiles after spending $1,000 in the first three months

Value of Introductory Bonus: Approximately $420

Annual Fee: $99

Hilton Honors American Express Surpass Card

Hilton Honors American Express Surpass Card earns 12 Hilton Honors Bonus Points per dollar on Hilton purchases, 6 points per dollars on dining, groceries, and gas, and 3 points per dollar on everything else. You can earn a free weekend night after you spend $15,000 in a calendar year. We recently redeemed a free night certificate at Waldorf Astoria Chicago, which would have cost over $400 per night if we paid cash.

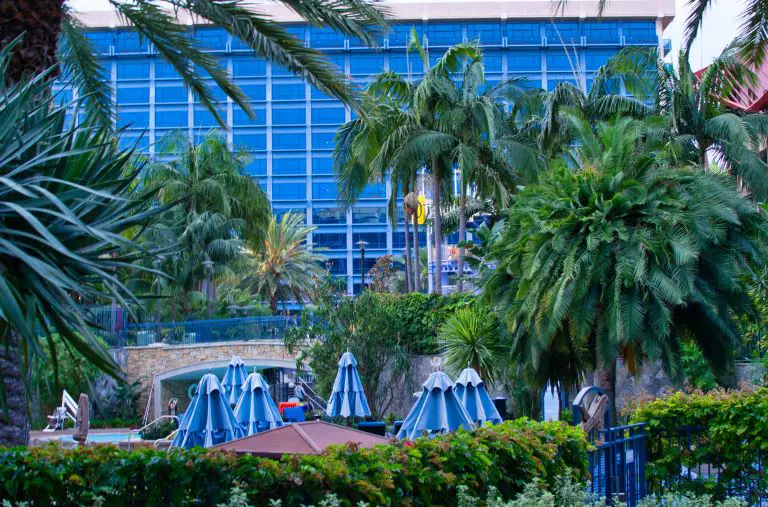

The card gives you complimentary Gold status with Hilton, which comes with perks, including free breakfast at most properties. It also comes with ten Priority Pass airport lounge visits per year. We have used our Hilton Honors points several times including our trip to San Diego and Waldorf Astoria Chicago.

Introductory Bonus: 125,000 Hilton Honors Bonus Points after spending $2,000 in the first three months

Value of Introductory Bonus: Approximately $750

Annual Fee: $95

Final Thoughts

Juggling credit cards is time intensive and overwhelming, but it is completely worth it. Do your research before applying, and apply in a strategic order. Space out your applications. Use apps like NerdWallet to monitor your credit and AwardWallet to keep track of your miles and points. I understand it can be daunting to start, but don’t let that stop you. Rack up some miles, travel with your family, and make memories. You wouldn’t want to miss that temper tantrum abroad.

Great, helpful content. Only a fan of a credit card if you can pay it off every month and take advantage of the rewards. We used our United cc rewards to buy 5 of our 6 flights to Cancun and it was awesome.

Was thinking of applying for the Saphire so thank you for the input!

THis is great information I love credit card deals!!!

I thought I knew about reward cards, but I learnt something new, which I will be sure to use.

> they will usually pro rate the annual fee.

I just missed one last month.

I’m a little embarrassed to admit that even in adulthood I operate on the premise of avoiding credit cards. I’m doing much better, but this detailed information on the best credit cards for beginners will embolden me to utilize credit cards effectively.

I have been looking into the Chase Sapphire card. This is a great list of potential alternatives! Thanks for sharing!

Great list! It’s also a good time to apply for a cash back credit card right now since miles and points may have less value if you can’t book travel because of good ‘ole coronavirus.

This is soooo helpful! I love to travel so finding the right credit card for travel points is important to me. Thank you for sharing all of these options!

So useful! I had been thinking about getting into using cards for travel and this post helps a lot.

Great information! It’s so neat how the rewards adds up. I love my Chase Sapphire and how much I’ve gotten out of it. Like you mentioned, the tricky part is keeping track of the different cards. Thanks for the breakdown.